Product

Win Loss Analysis Template That Actually Improves Decisions

The deals you lose are trying to tell you something

Most teams say they do win-loss analysis. Almost none of them learn anything from it.

Deals close. Notes pile up in the CRM. Someone drops a slide into a QBR. Then the same competitor keeps winning, the same objections keep surfacing, and the same roadmap debates go nowhere.

That gap is not about effort. It is about structure.

Win-loss analysis only works when it forces decisions. When it doesn’t, it turns into storytelling after the fact.

Why win loss analysis keep failing

The failure patterns are boringly consistent.

The data is fuzzy. One loud deal outweighs ten quiet ones.

The categories are lazy. Everything collapses into “price” or “product fit”.

The output is passive. Insights get written down, then ignored.

The format resets every quarter. Nothing compounds.

On paper, the report looks complete. In practice, nothing changes.

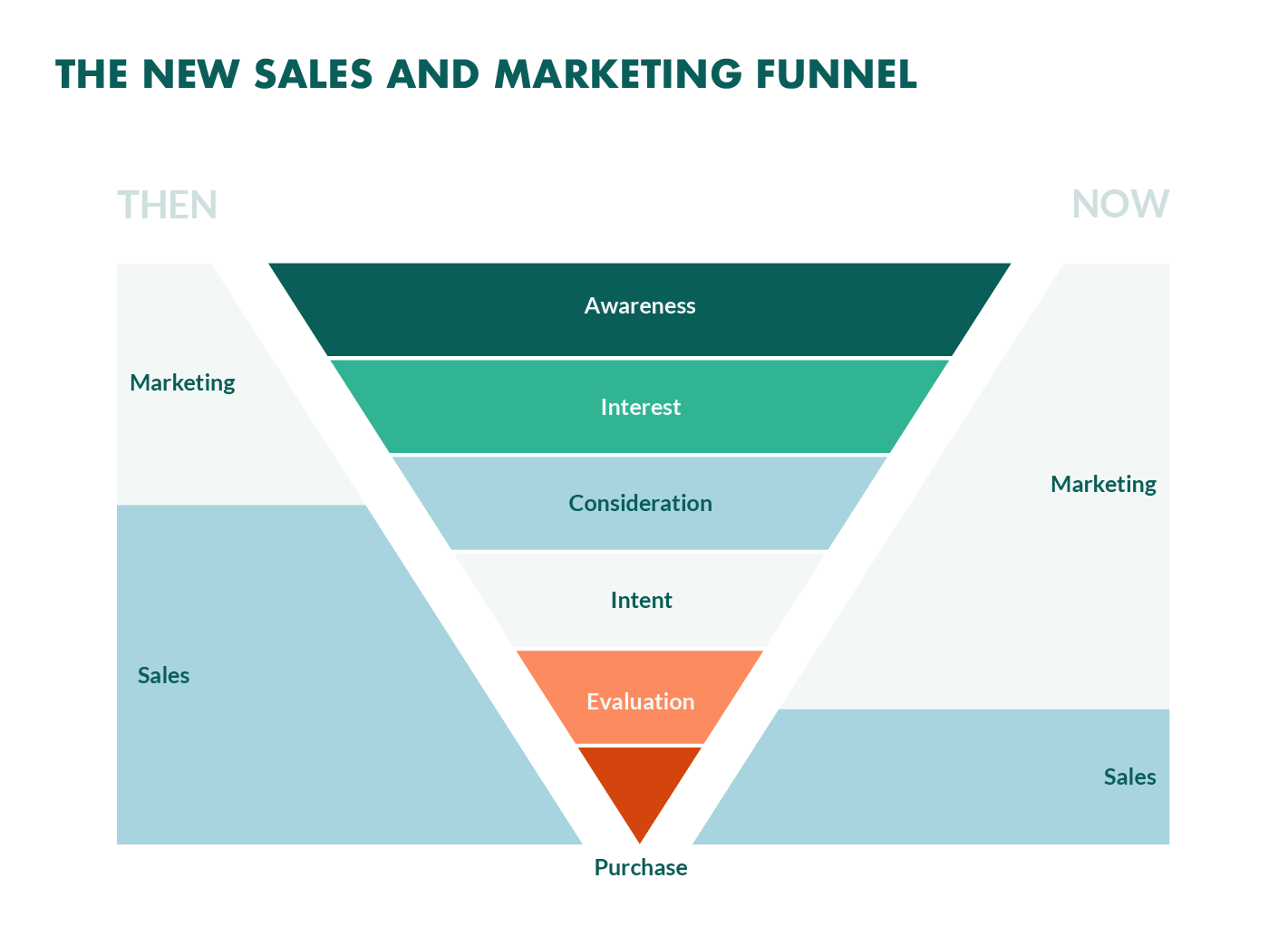

What win loss analysis is supposed to do

A useful report answers four questions without wiggle room.

What changed since last period

Why buyers chose us or walked away

Where competitors consistently beat us

What decision follows from this

If your template does not force those answers, it will drift into commentary.

A framework that keeps teams honest

This five-part structure shows up again and again in teams that actually improve quarter over quarter.

1. Lock the context first

Define the period. Name the owner. State the data sources.

CRM notes, interviews, surveys, all tell different truths. Mixing them without clarity creates noise and invites argument. Context shuts that down early.

2. Separate outcomes from explanations

Start with what happened.

Wins. Losses. Win rate. Deal size. Sales cycle. Compared to the last period.

Only then move to why.

This creates tension. A stable win rate with shrinking deal size tells a different story than a falling win rate with faster cycles. You cannot see that if you jump straight to opinions.

3. Make reasons specific or make them disappear

“Price” is not a reason.

“Lost 12 percent to competitor on enterprise tier” is.

“Missing feature” is not a reason.

“No SOC 2 Type II at time of legal review” is.

Strong templates limit choices and force detail. Fewer buckets. Better thinking.

4. Treat competitors as patterns, not anecdotes

One painful loss is a story. Five similar losses are a signal.

Track head-to-heads by competitor. Track win rates against each. Capture themes that repeat across deals.

This is where strategy lives. Not in the loudest deal, but in the quiet patterns nobody can argue with.

5. End with decisions, not observations

Insights without owners are trivia.

Every report should end with clear actions across sales, product, pricing, or positioning. Even choosing to do nothing is still a decision. Write it down and own it.

What this looks like when it works

A SaaS team runs its quarterly review.

The topline looks fine. Win rate is steady. But losses to one competitor have doubled.

The raw reasons look scattered. Price. Security. Incumbent preference.

Grouped properly, a pattern snaps into focus. Procurement shows up late. Security documentation shows up even later.

The decision is not to cut price. It is to ship a security pack, move it earlier in the sales process, and enable reps to introduce it before legal gets involved.

Next quarter, losses to that competitor drop. No product changes required.

That only happens when the structure forces the pattern to surface.

The anatomy of a win loss analysis that earns its keep

A strong template follows a deliberate sequence.

Report metadata

Period, owner, date, data sources

Executive summary

Three to four sentences on what changed and why it matters

Deal outcomes

Wins, losses, win rate, deal size, cycle length, versus last period

Reasons won

Specific reasons, competitor considered, short notes

Reasons lost

Specific reasons, competitor chosen, short notes

Competitive landscape

Head-to-head counts, win rates, recurring themes

Customer feedback

Direct quotes and synthesized themes

Recommendations and next steps

Sales changes, product requests, pricing moves, positioning updates

Nothing clever. Nothing decorative. Just pressure in the right places.

Why templates matter more than analysis skill

Most teams already know how to analyze deals. What they lack is consistency.

Templates remove friction. They reduce cognitive load. They make the right behavior repeatable instead of heroic.

A good template does not tell you what to think. It tells you where to look and what you must decide.

That is why this win loss analysis template exists inside Assemble.

Where Assemble fits

Assemble is a template builder for serious knowledge work.

Not static documents that get copied and forgotten, but living structures teams reuse, adapt, and sharpen over time.

Win loss analysis is a perfect example. Same structure every quarter. Clear ownership. Outputs leadership can actually act on.

Less noise. Faster insight. Fewer repeated mistakes.

The point

If win loss analysis keeps showing up on your roadmap but never sticks, the problem is not discipline. It is design.

Fix the structure and the learning follows.

Build the template once. Let it do the hard work every quarter.

Explore the win loss analysis template in Assemble and make your next review count.