Product

Pricing Strategy Template for Smarter Packaging Decisions

The Pricing Strategy Template That Prevents Expensive Guesswork

Most pricing problems are not pricing problems.

They are alignment problems.

Teams change features. Sales offers discounts. Finance pushes for margin, marketing updates positioning. Suddenly, nobody can explain why a plan costs what it costs.

Revenue slows. Churn creeps up. Discounting becomes the default.

A strong pricing strategy template fixes this, not by picking a number, but by forcing clarity around value, segmentation, packaging, and financial impact.

If pricing touches revenue, growth, retention, positioning, and product roadmap, it deserves a system.

This guide walks through a practical pricing and packaging strategy framework you can actually use. It is built for serious knowledge work, not slideware.

Why Pricing Breaks Down

Before building a template, it helps to understand what usually goes wrong.

From working with scaling SaaS teams and product-led companies, five recurring issues show up:

Pricing is disconnected from customer value.

Tiers are feature dumps, not deliberate value ladders.

Segments are loosely defined or based on intuition.

Financial modeling happens after launch, not before.

Communication to sales and customers is reactive.

A pricing strategy template creates a repeatable structure that prevents these mistakes.

The 5-Part Pricing Architecture Model

Here is a practical mini-framework you can use to structure your pricing decisions.

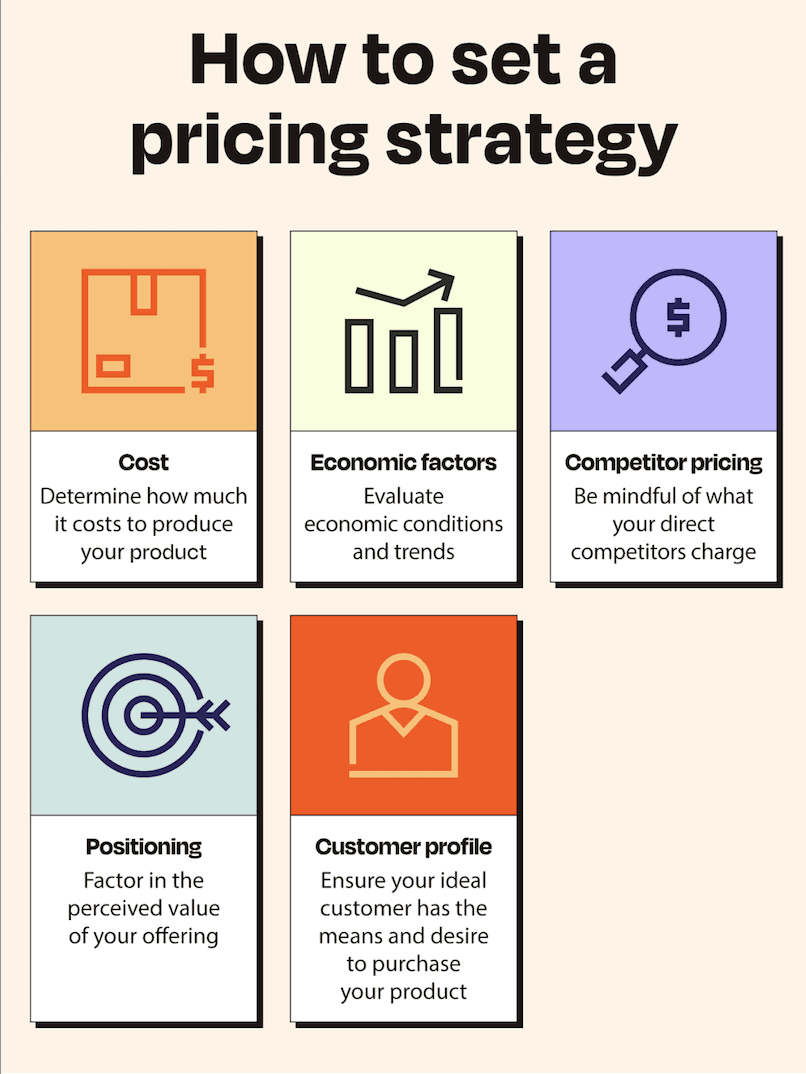

1. Value Anchor

What outcome are customers actually paying for? Speed, revenue, compliance, visibility, risk reduction?

If your pricing model is not tied to this anchor, it drifts.

2. Segmentation Logic

Who experiences that value differently? Startups, mid-market, enterprise. High-usage vs low-usage. Advanced operators vs casual users.

Clear segments prevent overcomplicated tiers.

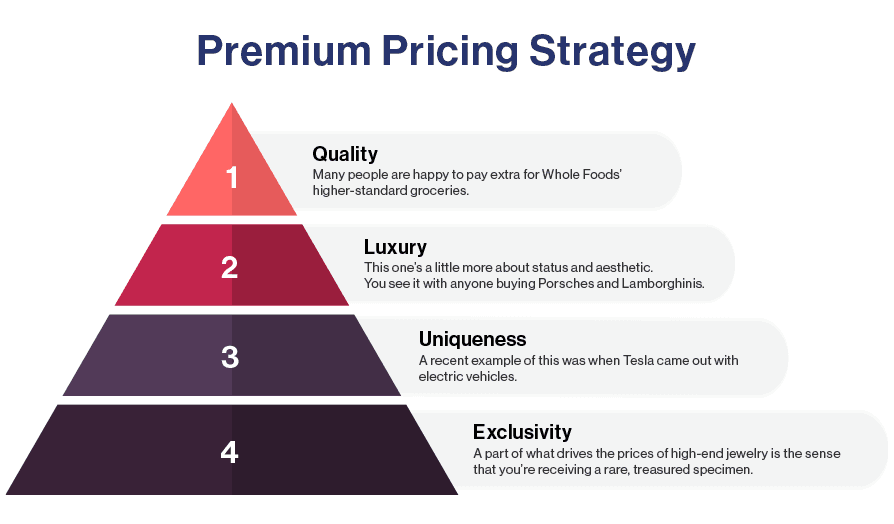

3. Packaging Ladder

What increases as customers grow? Seats, usage volume, automation, integrations, governance.

Each tier should map to a maturity stage.

4. Monetization Model

Per seat, per usage, flat rate, hybrid, freemium, value-based. The model should mirror how value scales.

5. Financial Impact

Forecast adoption, ARR, churn risk, and margin. Pricing without modeling is gambling.

Build your template around these five elements and most confusion disappears.

Building a Real Pricing Strategy Template

Below is a structured outline you can adapt into your own pricing strategy template.

1. Document Metadata

Track ownership and versioning. Pricing changes without documentation create internal chaos.

Include:

Product or service

Owner

Version and date

Reviewers and approvers

Treat pricing like a living system, not a one-off decision.

2. Objectives and Success Metrics

Pricing must serve a goal.

Common objectives include:

Target ARR or MRR

Improved conversion rate

Reduced churn

Higher gross margin

Expansion revenue

Decision point: Are you optimizing for growth, margin, or market share right now?

You cannot maximize all three at once.

3. Customer Segmentation

Most pricing mistakes come from vague segmentation.

Instead of “SMB” and “Enterprise”, define:

Buying trigger

Budget range

Core use case

Expansion potential

Current ARR contribution

Example:

Segment A

Early-stage teams buying for speed and simplicity. Sensitive to upfront cost. Low initial ACV but high lifetime expansion potential.

Segment B

Operationally mature teams needing integrations and governance. Higher ACV. Lower churn risk.

When segments are concrete, pricing tiers become obvious.

4. Pricing Model and Tier Structure

This is where structure matters.

For each tier define:

Price

Billing frequency

Features included

Target segment

Upgrade trigger

Avoid arbitrary “Basic, Pro, Premium” naming without meaning.

Each tier should correspond to a stage in the customer journey.

Ask:

What breaks first when a customer outgrows this tier?

What capability becomes essential at the next stage?

A strong pricing tiers structure feels inevitable, not invented.

Competitive Pricing Analysis Without Copying

Competitive benchmarking is useful, but dangerous if done lazily.

Instead of asking “What do they charge?”, ask:

What metric do they monetize?

What value do they anchor pricing to?

Where do they draw the line between tiers?

What objections are they pre-solving?

Your goal is positioning clarity, not imitation.

If a competitor charges per seat but your value scales with usage, copying them will distort your model.

Financial Modeling for Pricing Decisions

This is where most teams rush.

Build a simple financial modeling table per tier:

Target customers

Forecasted adoption rate

Average contract value

Churn assumptions

Expansion assumptions

Resulting ARR

Model at least three scenarios:

Conservative

Expected

Aggressive

Then pressure-test it.

What happens if conversion drops by 20 percent?

What if churn increases in your lowest tier?

What if discounting becomes standard practice?

Pricing is strategy. Strategy requires modeling.

What This Looks Like in the Real World

A growing SaaS product introduced a “Premium” tier because customers asked for more features.

They bundled advanced analytics, integrations, and priority support into one expensive plan.

Adoption stalled.

After revisiting their pricing strategy template, they discovered:

Analytics drove value for mid-tier customers.

Integrations were enterprise-only needs.

Priority support mattered only to high-revenue accounts.

They split the plan into two tiers aligned with actual usage maturity.

Within one quarter:

Conversion increased.

Discounting decreased.

Expansion revenue improved because upgrade triggers were clearer.

The difference was not the price. It was the structure.

Risks and Trade-Offs to Document

Every pricing and packaging strategy carries risk.

Document explicitly:

Price sensitivity by segment

Churn risk by tier

Likely competitive response

Sales objections and discount pressure

If your lowest tier is too generous, you kill upgrades.

If your highest tier is too abstract, you stall enterprise deals.

Write these trade-offs down. Future you will thank you.

Rollout and Internal Alignment

Even perfect pricing fails without communication.

Your template should include:

Internal enablement sessions

Updated sales scripts

FAQ for objections

Website messaging updates

Review cadence

Pricing is not a launch. It is a system that needs monitoring.

Set a quarterly review rhythm. Track performance against your original assumptions.

Why Templates Matter in Pricing Strategy

Most teams build pricing in scattered slides, Slack threads, and spreadsheets.

That fragmentation creates misalignment.

A structured pricing strategy template:

Forces clarity on assumptions

Speeds up decision-making

Improves cross-team alignment

Makes updates repeatable

Reduces internal debate

This is exactly where Assemble fits.

Instead of rebuilding your pricing and packaging strategy from scratch every time, you can create a structured, reusable template that captures segmentation logic, tier rationale, financial modeling, and rollout steps in one place.

Assemble makes that framework living and adaptable, not trapped in a one-off document.

The Next Step

If pricing decisions feel reactive, unclear, or political, it is time to formalize the system.

Start by documenting:

Your value anchor

Your segments

Your tier ladder

Your monetization model

Your financial assumptions

Turn pricing from debate into design.

Build your own pricing strategy template inside Assemble and make every future update faster, clearer, and smarter.

Stop guessing on pricing. Start documenting it properly with Assemble.